Microsoft’s Bold Strike in AI Hardware Wars

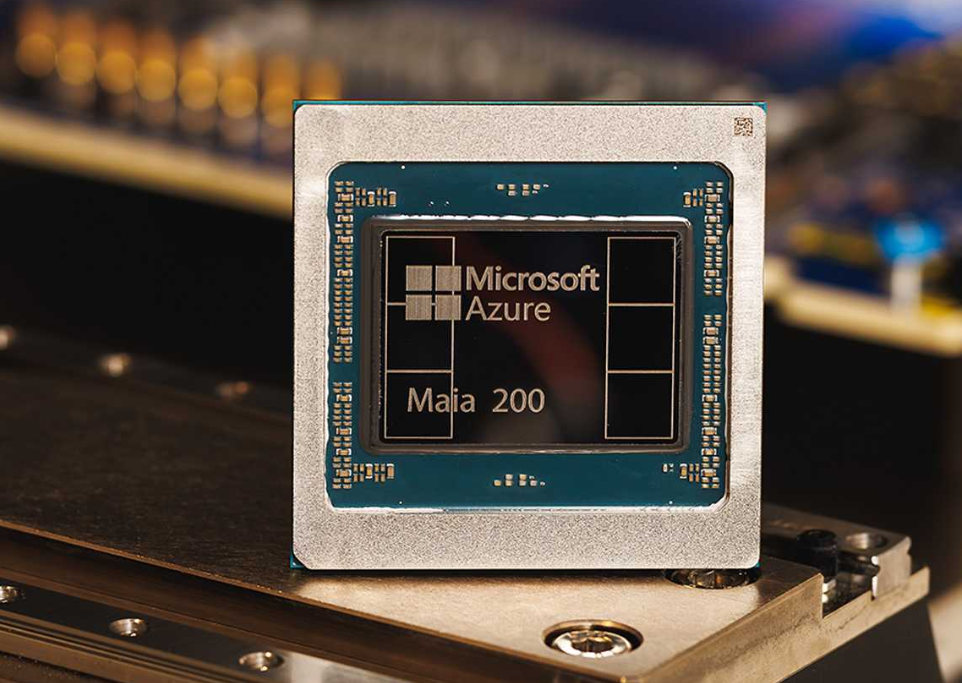

Microsoft just dropped a bombshell in the AI chip race. On Monday, the company unveiled the Maia 200, its latest custom AI accelerator built to muscle in on Nvidia’s iron grip. This second-generation chip hits data centers this week, starting in Iowa and rolling out to Arizona next. It’s Microsoft’s clearest signal yet: no more begging Nvidia for every AI compute need.

The Maia 200 targets the heavy lifting of AI inference, the phase where models like chatbots process real-world queries at scale. Microsoft boasts it crushes competitors, delivering triple the FP4 performance of Amazon’s Trainium 3 and Google’s TPU lineup. Built on cutting-edge 3-nanometer tech from Taiwan Semiconductor, it packs high-bandwidth memory, though not quite the bleeding-edge stuff Nvidia teases in its upcoming Vera Rubin chips.

This isn’t just hardware flexing. Microsoft knows Nvidia’s real fortress is software. Enter Triton, an open-source tool co-developed with OpenAI. Triton lets coders skip years of Nvidia-specific CUDA training and still hit expert-level speeds on GPUs. OpenAI first unleashed it back in 2021, and now it’s powering Maia 200. Developers stuck in Nvidia’s ecosystem might finally eye the exit.

Picture the stakes. Nvidia holds about 85 percent of the AI accelerator market, raking in billions as cloud giants scramble for capacity. But that dominance fuels resentment. Microsoft, Amazon, Google, and others burn cash on Nvidia gear while dreaming of independence. Custom silicon promises lower costs, tighter integration, and freedom from supply squeezes.

The Ripple Effect on Big Tech’s Silicon Rush

Microsoft didn’t invent this game. Google kicked it off with its TPU chips years ago, now drawing eyes from Nvidia heavyweights like Meta. Meta’s tweaking software to bridge TPUs with Nvidia’s world, hinting at a multi-vendor future. Amazon’s Trainium chips power its own AI services, quietly chipping away at the leader.

New players amplify the chaos. Cerebras just inked a $10 billion pact with OpenAI for wafer-scale engines that dwarf traditional chips. Groq, another upstart, licensed its tech to Nvidia itself in a rumored $20 billion deal, blending startup speed with giant scale. Microsoft borrows their tricks, stuffing the Maia 200 with heaps of SRAM memory. That fast cache shines in high-traffic AI like user floods on Copilot or Bing.

Maia 200 follows the 2023 Maia 100, but delays hit hard. OpenAI demanded design tweaks, staff jumped ship, and mass production slipped to 2026. Those hiccups underscore the risks: building frontier chips demands armies of talent and flawless execution. Yet Microsoft pressed on, proving in-house silicon pays off for hyperscalers controlling their own fate.

Deployments start small but scale fast. Iowa’s data center goes live immediately, Arizona follows. Expect Maia 200 to underpin Azure’s AI offerings, from enterprise tools to consumer apps. Microsoft envisions it handling the inference explosion as models grow smarter and users multiply.

Nvidia’s Moat Under Siege

Nvidia’s edge isn’t raw silicon. It’s CUDA, the software glue binding millions of developers. Switching means retraining teams, rewriting code, risking performance dips. Triton attacks that head-on. OpenAI swears novices match pros, slashing barriers. If it delivers, Maia 200 becomes a viable Nvidia alternative overnight.

Wall Street watches closely. Analysts peg Nvidia’s software as its ultimate moat, harder to breach than fabs or fabs. Microsoft pairs Maia hardware with Triton to erode it. Success could slash Azure’s Nvidia bills by billions, freeing cash for more R&D.

Broader forces converge. US-China tensions throttle advanced chip exports, spiking demand for domestic alternatives. Cloud providers hoard capacity, delaying startups. Custom chips sidestep that, tailoring silicon to workloads like training massive models or serving inferences.

Microsoft’s timing feels perfect. Nvidia’s Blackwell chips face delays, Vera Rubin looms distant. Maia 200 slips in now, proving second-gen custom silicon works. OpenAI’s fingerprints everywhere, from Triton to design input, signal deep Azure ties fueling this push.

What Happens When Giants Build Their Own Brains?

Cloud titans control 70 percent of global compute. Their silicon bets reshape AI economics. Lower costs mean cheaper services, accelerating adoption. But fragmentation looms: will developers juggle Maia, TPU, Trainium codebases? Or does Triton-like innovation unify them?

Nvidia fights back hard. It licenses tech from foes like Groq, bolsters CUDA with new tools, courts every hyperscaler. CEO Jensen Huang touts an “open ecosystem,” but revenue screams lock-in.

For Microsoft, Maia 200 cements its AI stack. Azure becomes a one-stop fortress: custom chips, OpenAI models, Triton software. Competitors scramble. Amazon pushes Trainium harder, Google refines TPUs for outsiders.

End users win long-term. More options drive prices down, spark innovation. Chatbots get snappier, drug discovery faster, code smarter. But short-term turbulence hits: supply gluts, margin squeezes, talent wars.

The industry hurtles toward multipolarity. Nvidia ruled unchallenged; now rivals circle. Maia 200 isn’t dethroning it tomorrow. But it’s a declaration: the king faces real contenders.

Does this spark an AI chip price war? Or does Nvidia’s software magic hold firm? Microsoft’s move forces everyone’s hand. The next year decides if custom silicon reshapes tech’s power balance.